Versions Compared

Key

- This line was added.

- This line was removed.

- Formatting was changed.

This article details how a user can navigate and interpret Total versus Actual store summary report inside the Decision Logic web application (platform).

Site Menu Navigation

Reports > Cost and Variance > TvA Store Summary

Overview

The TvA (Theoretical vs. Actual) Store Summary Reporting is a financial-driven report showing Theoretical Usage cost, Actual Usage cost, and the difference between the two costs as a Variance dollar amount.

In addition to costs associated with ingredients used in menu item recipes, TvA reporting considers all inventoried and distributor items that have a COGS Accounting Category assigned to them.

Features

Cost analysis and planning

Recipe usage monitoring

Store-level oversight

In conjunction with other Food Cost reporting, bonuses

Example Scenario

”At this store last week, $500.00 worth of Seafood theoretical cost should have been used, based on the Menu Items that were rung in and the Seafood ingredient portions in the recipes. Based on Inventories and Purchases, the actual cost shows that they used $600 worth of Seafood. Drilling into the TvA Store Summary Detail for Recipe Cost, I see that the first ingredient listed, Salmon, has the largest variance (loss).”

“After speaking with the store manager, we found that the prep cook was portioning 7oz Salmon Filets instead of 6oz. Since this has been corrected going forward, we should see a smaller variance for Salmon, Seafoods, and Food next week.”

Table of Contents

| Table of Contents | ||||

|---|---|---|---|---|

|

| Info |

|---|

For additional questions or assistance, please submit a support ticket by visiting the Decision Logic Service Center. |

Getting Started

When viewing TvA Store Summary reporting, users are able only to view one store at a time. This report does not provide a rollup for all locations.

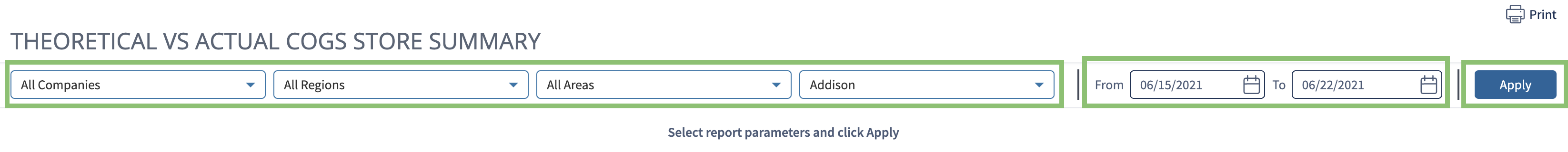

Selecting a Store

Select the Company, Region, Area, and/or Store

Choose the Date Range

From date must be an Inventory date

To date must be the last date in the inventory week

⭐ This is the date before the next week’s Inventory Date

Select Apply

Users will need to select Apply each time switching dates and/or stores to display accurate information.

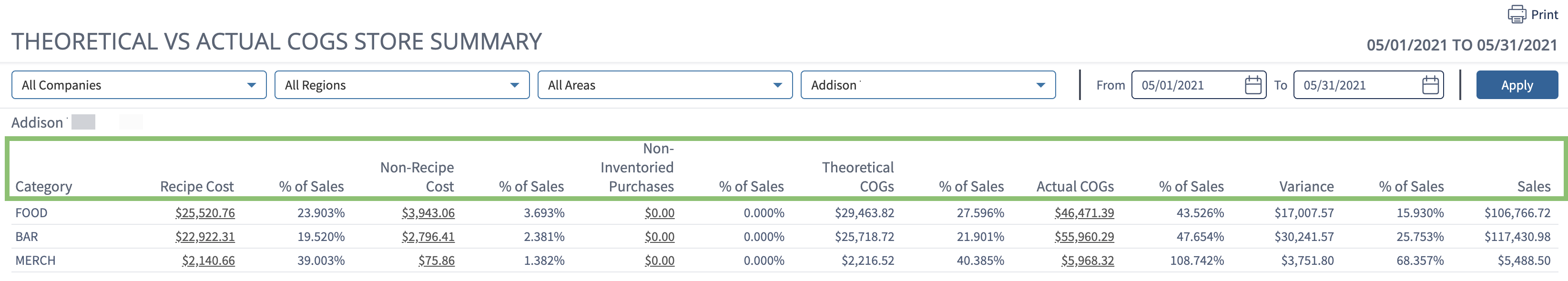

The store summary page will display a host of information. Below is an example of what you will see and the definitions and calculations for the columns in the table.

Definitions and Calculations

Metric/Column | Definition | Calculation |

|---|---|---|

Category | These are the parent COGS Category Sections which break down child COGS Categories that fall into each Section. | COGS structure is configured in COGS Maintenance. |

Recipe Cost | Usage of any Ingredient that is flagged for IvA in Ingredient Management. | Menu Mix Recipe Unit Usage x $/Recipe Unit Example: Chicken = $0.50/OZ |

Non-Recipe Cost | Usage of any Ingredient that is not flagged for IvA in Ingredient Management, regardless if an ingredient is in a recipe. | Since there is not Recipe Usage, Actual COGS Usage (BI + P - EI) is used. The reporting requires that it meets at least 1 of 3 conditions:

Example:

|

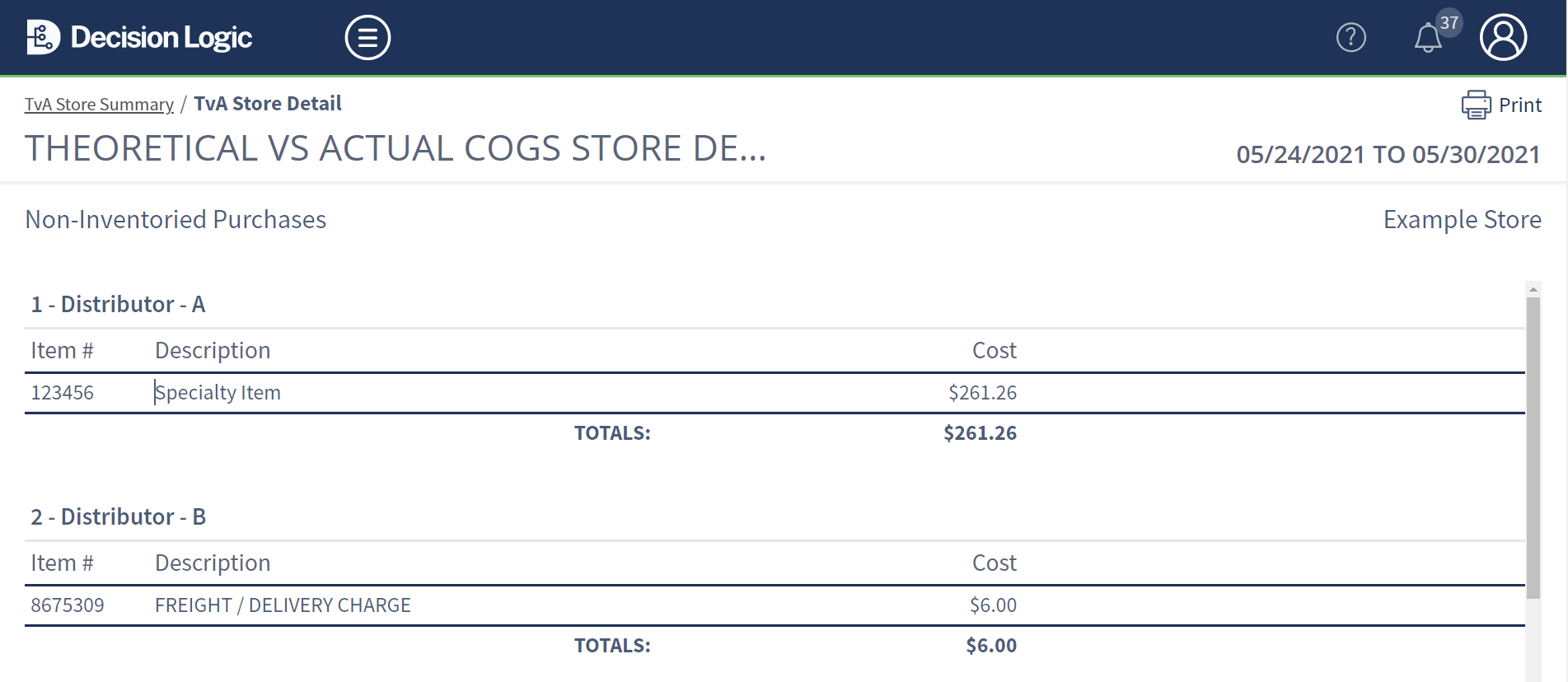

Non-Inventoried Purchases | Includes any distributor item received on an order (purchase) that was assigned to a COGS Category, but not assigned to an Ingredient. | Since there is no ingredient to determine Recipe Usage or Inventoried values, the system uses the Purchased value as the (Non-Inventory Cost) Theoretical Usage. Example: |

Theoretical COGS | Total Theoretical Cost of Goods Sold per COGS Section or COGS Category | Recipe Cost + Non-Recipe Cost + Non-Inventory Cost = Theoretical Cost of Goods Sold |

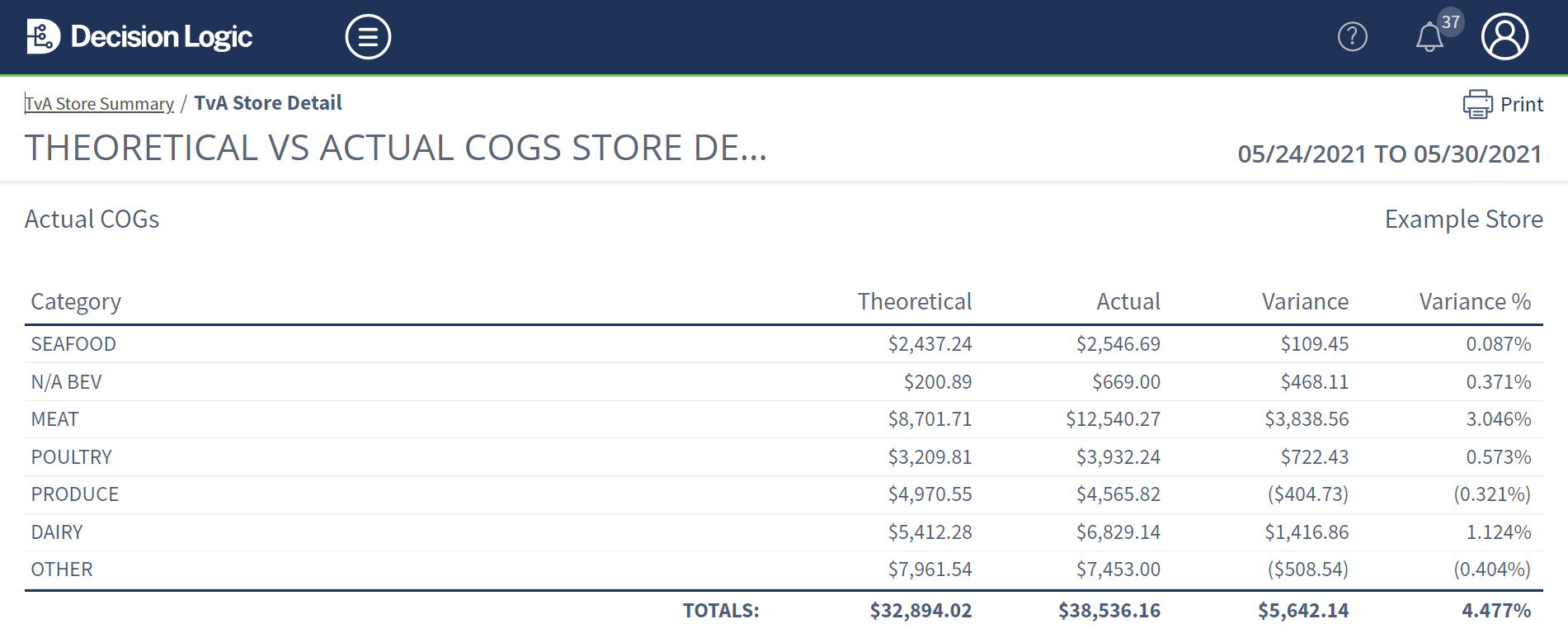

Actual COGS | Beginning Inventory + Purchases - Ending Inventory = Actual COGS Includes child COGS Categories that fall under the parent COGS Category Section that have at least one Ingredient or Distributor Item with at least one of the following:

| Sum of Recipe, Non-Recipe, and Non-inventory purchases

|

Variance | The difference between Actual and Theoretical Cost of Goods Sold | Actual COGS - Theoretical COGS = Variance |

Sales | Sales per COGS Section and Category are by assigned POS Admin Department. | Sales are allocated in COGS Maintenance. |

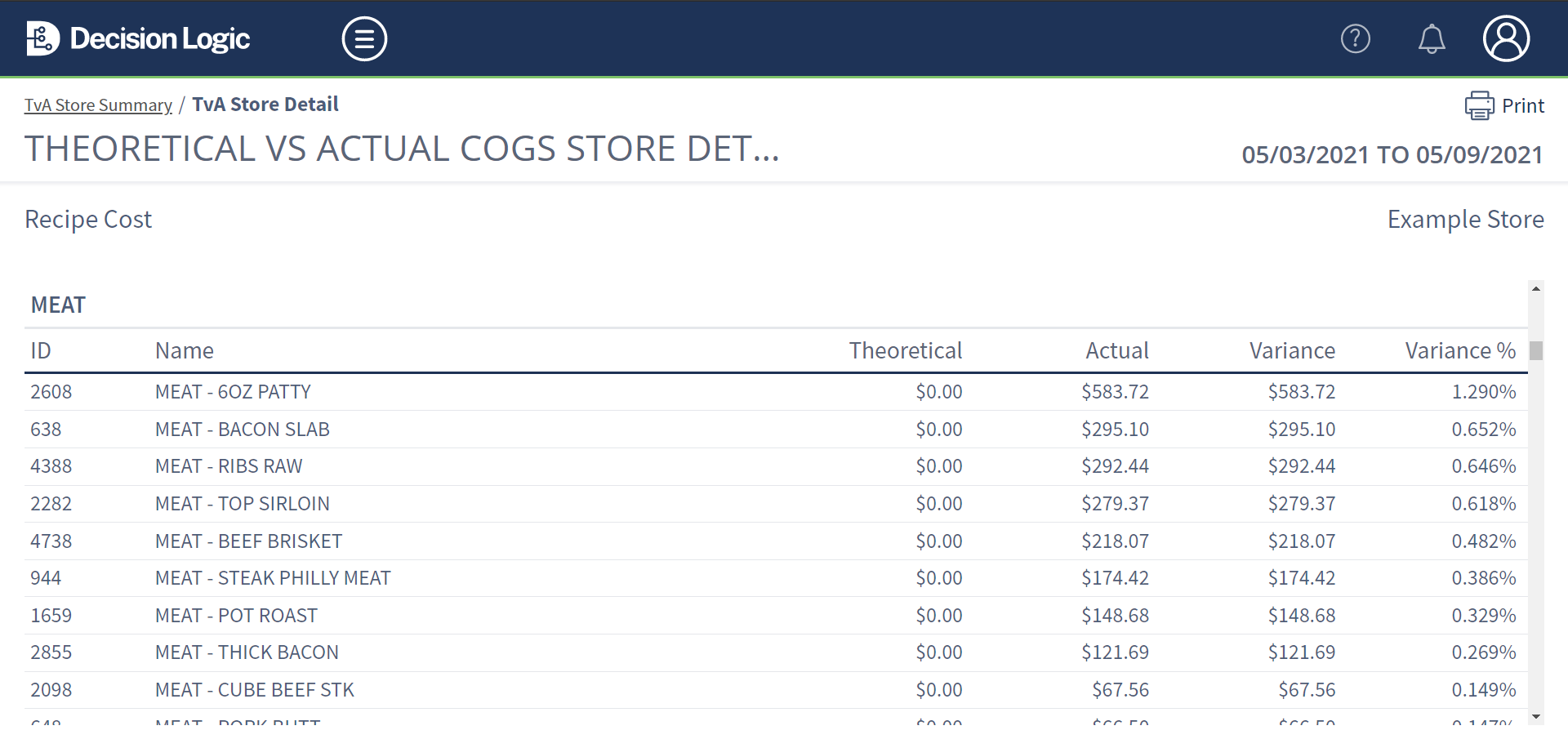

Store Summary Detail Views

Store Summary detail views display item details sorted by variance; largest positive (theoretical loss) to largest negative (theoretical growth).

Each view has the option to 🖨 Print the report.

Recipe Cost

Selecting a COGS Section's Recipe Cost value displays each Ingredient’s Theoretical Cost, Actual Cost, Variance of the two in the dollar, and percent amount representative of the COGS Category’s Sales. The Ingredient’s COGS Category groups these.

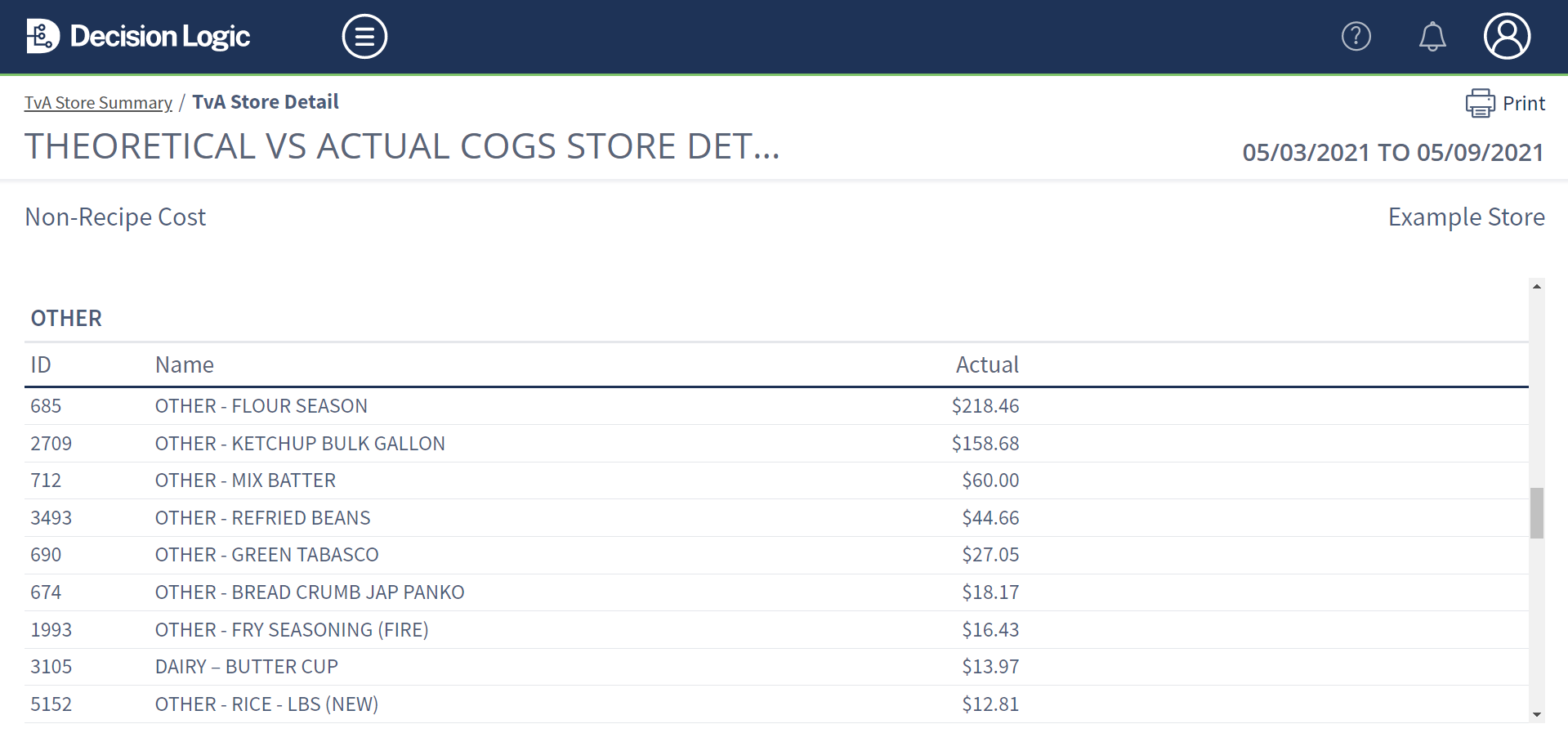

Non-Recipe Cost

Selecting a COGS Section's Non-Recipe Cost value displays each ingredient’s Actual Cost.

⭐ The cost for Non-Recipe Ingredients uses the Actual Cost. The Ingredient’s COGS Category groups these.

Non-Inventoried Purchases

Selecting a COGS Section's Non-Inventoried Purchases value displays each Distributor Item’s Actual Cost.

⭐ The theoretical cost for Non-Inventoried Purchases shows the Actual Cost (Purchase). The item’s Distributor groups these.

Actual COGS

Selecting a parent COGS Section's Recipe Cost value displays each child-COGS Category’s Theoretical Cost, Actual Cost, Variance of the two in the dollar, and percent amount representative of the COGS Category’s Sales.

Related Articles

(Don’t forget to edit Macro labels)

| Filter by label (Content by label) | ||||||||

|---|---|---|---|---|---|---|---|---|

|

| Info |

|---|

Unable to access this feature in the Decision Logic platform?

|